A REFORMA TRIBUTÁRIA: Quando um País necessita de recursos, torna-se necessário criar um novo imposto ou aumentar as alíquotas dos existentes. Quando um País não cumpre seus deveres com o cidadão, os contribuintes aprenderão a sonegá-los.

A complexidade de nosso Sistema Tributário motivador da corrupção, é covarde e mais uma vez ilude o povo, o Presidente Bolsonaro, todos os Presidentes anteriores e até mesmo os “Legisladores”…

“Deus” age segundo as Leis de Causa

e efeito por ele mesmo instituída!

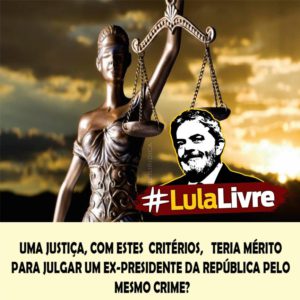

-“Lula”, talvez o melhor político.

-“Camilo”, certamente o melhor Fiscal.

A EVOLUÇÃO DA “ESPÉCIE HUMANA”- I

Quanto “Pior” forem às pessoas que tiverem que sujeitar, melhor será para sua evolução. Podemos encontrar os “piores” seres humanos entre: Políticos, Policiais, Fiscais de Rendas, ex-mulheres, Juízes, Promotores, Desembargadores… ENFIM, EVOLUÍMOS É NA RAÇA!!!

A EVOLUÇÃO DA “ESPÉCIE HUMANA”II

Tenho necessidade da conclusão real da prisão do presidente Lula, que poderia ser descaracterizada pela desmoralização da Justiça em meus processos (penal e familiar). Informando que o julgamento por políticos os torna insanos. A sede de poder os fazem verdadeiros “psicopatas”: Mentem, driblam, enganam, corrompem…etc. “IN DUBIO PRO REO”.

TUDO NA VIDA É PASSAGEIRO, MENOS O MOTORISTA, O TROCADOR, A “CORRUPÇÃO BRASILEIRA” E A PROSTITUIÇÃO!

“Na “Prostituição” a ausência de pudor surge pela necessidade”.

“Na “Prostituição” a ausência de pudor surge pela necessidade”.

“Na Corrupção a perda dos princípios éticos e morais surgirão proporcionalmente a ineficiência dos órgãos públicos correspondentes”.

-A cada 100.000 homens, subjugados como fui, nesses 22 anos, 99.999 morrerão. Sobrará apenas 01(um), e “ESTE SOU EU”. Tenho uma missão!

a

S A B E D O R I A S:

S A B E D O R I A S:

1- Matem uma cobra, mas certifiquem de que esta esteja morta mesmo, pois existem milagres, e se Deus desejar que ela sobreviva, esta o punirá com muita consistência 22 anos depois.

Minha vida é só “tristeza” e não é a única de nossa Justiça!

3-EXISTEM 02 BICHOS INTERESSEIROS: PATOS, POR MILHOS; E COBRADORES DE IMPOSTOS (FISCAIS), POR SUBORNO.

3-EXISTEM 02 BICHOS INTERESSEIROS: PATOS, POR MILHOS; E COBRADORES DE IMPOSTOS (FISCAIS), POR SUBORNO.

-Perdoem-os, Senhor, eles não sabem o mal que fazem a si próprios e à sociedade!

A cada 100 (cem) processos julgados pela nossa “Justiça”, em todo o País, apenas 8 (oito) não conterão erros.

A cada 100 (cem) processos julgados pela nossa “Justiça”, em todo o País, apenas 8 (oito) não conterão erros.

Água para morro abaixo, fogo para morro acima:

Deputados, Senadores e Fiscais de Rendas, quando são corruptos,

Ninguém os segura!

-90% dos crimes cometidos na Inglaterra serão descobertos

-65% dos crimes cometidos nos USA serão desvendados.

-5 a 8% dos crimes cometidos no “BRASIL” correm o “risco”de serem descobertos!

JURAVA NÃO MERECER A DESGRAÇA QUE RECAIU SOBRE MIM!

SE ACONTECEU, EU REALMENTE MERECIA O CRESCIMENTO EFICAZ,

PROPORCIONADO PELAS “DIVERSAS EXPERIÊNCIAS”!

“Em um ambiente nefasto e desacreditado, a virtude de um homem, deverá ser avaliada em função do número de inimigos que adquirir” !